The Ins and Outs of Getting a Second Mortgage in Ontario

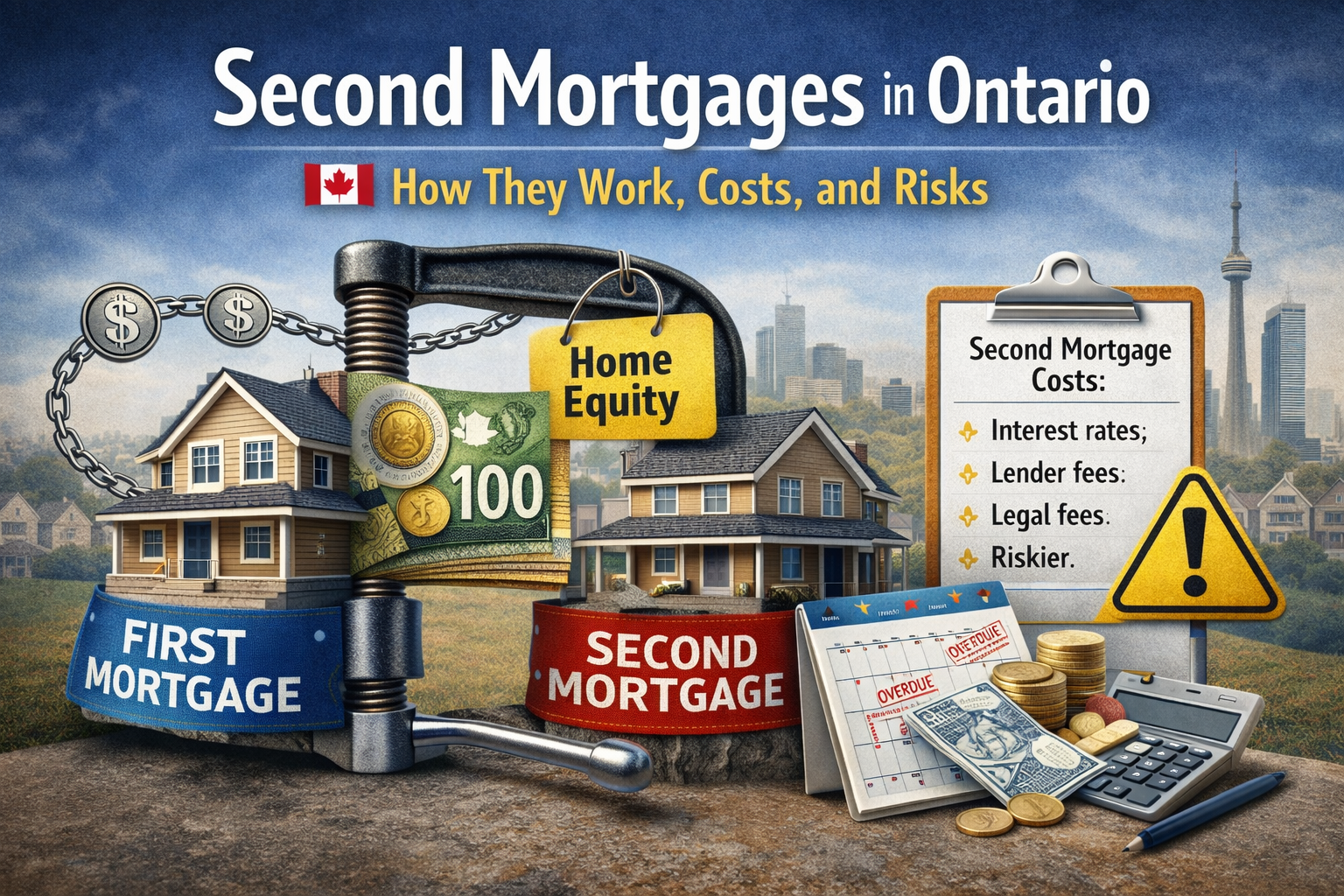

A second mortgage can be a powerful financial tool — or a costly mistake — depending on how it’s structured and why it’s used. In Ontario, second mortgages are common, but they’re often misunderstood.

This guide walks through how second mortgages work, when they make sense, the risks involved, and what Ontario homeowners need to know before moving forward.

What Is a Second Mortgage?

A second mortgage is a loan secured against a property that already has an existing first mortgage.

• The first mortgage is paid first if the property is sold or foreclosed

• The second mortgage sits behind it in priority

• Because of that risk, second mortgages usually carry higher interest rates

The loan is secured by the same property, using the homeowner’s available equity.

How Much Can You Borrow?

In Ontario, most lenders follow these general guidelines:

• Combined loan-to-value (CLTV) typically capped at 80–85%

• The property must have sufficient equity after the first mortgage

• Example:

• Home value: $800,000

• First mortgage: $500,000

• Maximum lending at 80% = $640,000

• Potential second mortgage = up to $140,000 (before fees)

Private lenders may allow higher leverage, but risk and cost increase accordingly.

Why Homeowners Use Second Mortgages

Second mortgages are usually purpose-driven, not lifestyle loans.

Common reasons include:

• Debt consolidation

• Tax arrears or CRA balances

• Emergency expenses or cash flow shortfalls

• Business or self-employment needs

• Bridge financing

• Preventing power of sale

• Divorce or settlement payouts

They’re often used when traditional refinancing isn’t available or doesn’t make sense.

Types of Second Mortgages in Ontario

1. Bank or Credit Union Second Mortgages

• Lower rates

• Stricter qualification

• Strong credit and income required

2. Alternative (B-Lender) Seconds

• More flexible underwriting

• Higher rates than banks

• Often used when income is non-traditional

3. Private Second Mortgages

• Asset-based lending

• Focus on property value and exit strategy

• Higher interest rates and fees

• Shorter terms (6–24 months common)

Private seconds are common in Ontario, especially for time-sensitive situations.

Costs You Should Expect

Second mortgages are more expensive than first mortgages. Typical costs include:

• Higher interest rates

• Lender fees

• Broker fees (where applicable)

• Legal fees

• Appraisal costs (if required)

Some second mortgages are interest-only or interest paid up front, depending on structure.

Risks to Understand

Second mortgages are not risk-free.

Key risks include:

• Higher monthly or lump-sum costs

• Increased leverage on your home

• Less flexibility if property values decline

• Limited refinancing options if the loan isn’t exited properly

A second mortgage should always have a clear exit strategy — sale, refinance, income recovery, or asset liquidation.

Who Qualifies?

Qualification depends on the type of lender, but generally:

• Property equity matters more than credit score

• Income requirements vary widely

• Credit issues may be acceptable with sufficient equity

• The purpose of funds and exit plan are critical

In private lending especially, the deal is underwritten around risk and repayment, not just income.

Is a Second Mortgage Right for You?

A second mortgage can be a solution when:

• Timing matters

• Cash flow is temporarily tight

• Traditional lenders say no

• Equity is available but income is constrained

It’s not a long-term fix for structural financial problems — but it can be an effective short-term or strategic tool when used correctly.

Final Thoughts

Second mortgages play a real role in Ontario’s housing and lending landscape. When structured properly, they can solve immediate problems and buy time. When misunderstood or rushed, they can create new ones.

Understanding the mechanics, costs, and risks upfront is essential before moving forward.